Welcome to the calm before the Covid-19 storm.

The medtechs that enjoy the highest sales for their headcount tend to be those making large, expensive machines or largely genericized orthopedic implants – the types of product that tend to require relatively little in the way of R&D expenditure. But these devices are heavily used in elective procedures, and this is exactly where demand has cratered so far this year thanks to the pandemic.

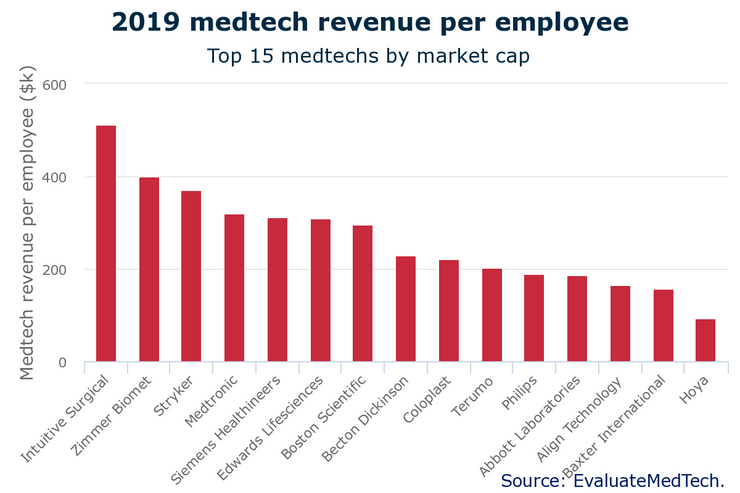

Evaluate Vantage’s annual analysis of medical device sales per employee pinpoints Intuitive Surgical, Zimmer Biomet, and Stryker as having been the most efficient medtechs on this metric in 2019. Next year the scene could look very different.

The revenue Intuitive enjoyed per staff member sat at $512,000 last year, more than $100,000 ahead of its nearest rival, the joint implant maker Zimmer Biomet. Intuitive makes the da Vinci line of surgical robots, and currently has the market for robotic soft tissue procedures pretty much to itself. This is expected to change over the next year or two as Medtronic launches its rival machine, known as Hugo.

But Intuitive is facing worse disruption than that. As hospitals prioritize the urgent care of Covid-19 patients they are shifting away from buying expensive equipment – many of the da Vinci models sell for more than a million dollars. In the second quarter of 2020 Intuitive shipped 178 da Vinci systems, a decrease of 35% compared with the 273 it placed in the second quarter of 2019. Overall, its second-quarter revenues slid 22% compared with the same period in 2019.

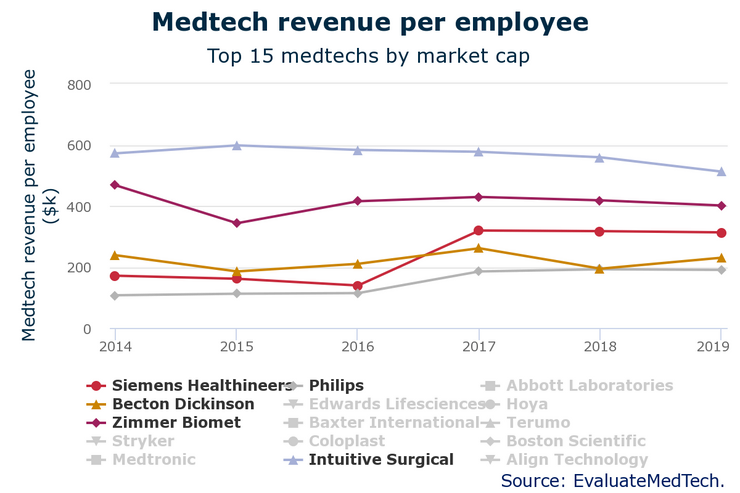

A similar pattern can be seen with Zimmer Biomet and Stryker, the orthopedics companies that take second and third place in the graph above. Stryker’s sales fell 24% year-on-year in the second quarter, and Zimmer’s were down 38% (Orthopaedics companies’ nightmare quarter, August 25, 2020).

While the third and fourth quarters are unlikely to be anywhere near as bad for these groups, 2020 will still end up being a dismal year. Unless these groups make swingeing cuts to their headcount their sales-per-staffer figure can only shrink next year.

Companies such as Abbott and Siemens Healthineers, meanwhile, could climb the rankings. Both were shielded from the worst of the pandemic’s effects by their Covid-19 diagnostic technologies.

Looking at the way this figure has changed over the past is also instructive. Excluding Siemens Healthineers, which saw a huge jump in medtech sales per employee after being spun out of its parent conglomerate in 2017, the winner is Philips, which has increased this figure 77% from 2014 to reach $190,000 last year.

Even here, though, a storm is gathering on the horizon. This week Philips admitted that its full-year sales would be negatively affected after the US government canceled an agreement to purchase ventilators for Covid-19 patients. The Department of Health and Human Services had arranged in April to pay $646.7m for 43,000 ventilators, but the contract was canceled after Philips had delivered just 12,300.

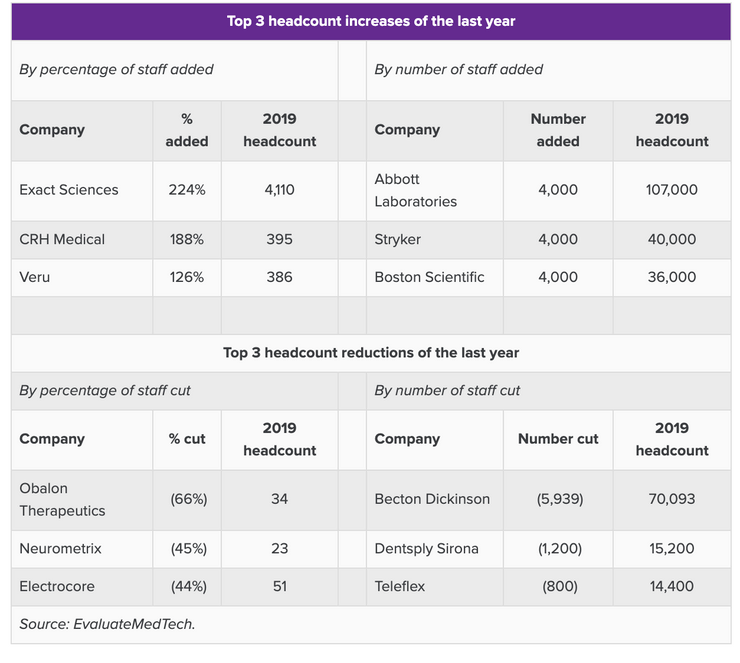

As for the biggest percentage headcount changes in the medtech sector, these are naturally enough found among the smaller companies. Exact Sciences, best known for its Cologuard colon cancer screening test, more than trebled its staff numbers last year, in part owing to the closure of its acquisition of Genomic Health. It will probably be hiring substantially this year too – it has an FDA-authorised Covid-19 diagnostic which helped plug the Cologuard sales shortfall in the second quarter.

Obalon Therapeutics, the maker of a swallowable gastric balloon intended as a therapy for obesity, reduced its headcount by a third from 2019 to 2020. Treating obesity with non-surgical medical devices is a field that has seen little success, and Obalon’s share price has haemorrhaged value since its IPO in 2016. Covid-19 will not help: the group has suspended sales to new patients in its retail treatment centers owing to the pandemic.